Reports are due every three months, so you’ll quickly get into a routine. At the end of each tax quarter, you have until the end of the tax month following that quarter to submit your report to HMRC. If you make a mistake, you have a further three tax months to submit a replacement.

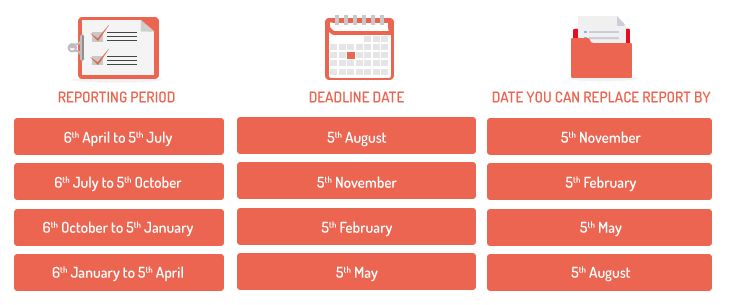

Here’s a timetable:

For more information, refer to Regulation 84F in The Income Tax (Pay As You Earn) (Amendment No. 2) Regulations 2015.